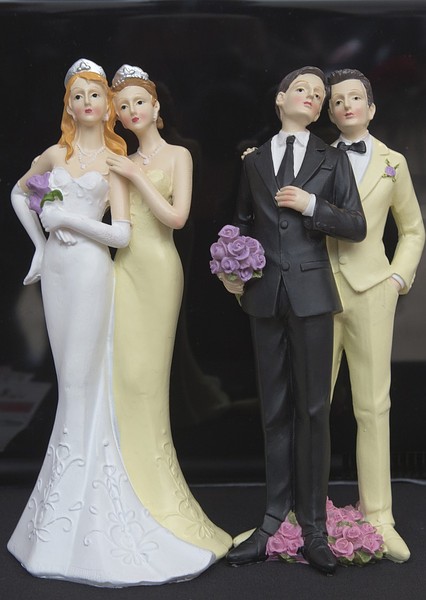

Photo: theblaze.com

Photo: theblaze.com

As a result of both the US vs Windsor case in 2013 and the recent Supreme Court decision legalizing same sex marriage in all 50 states, same sex spouses are now able to receive spousal support for healthcare, if a company offers that benefit, without any imputation of income from the employed spouse. Employees with same sex spouses who were previously covered under domestic partner benefits should have implemented a change in marriage status with their employer after the Supreme Court decision to ensure that income was no longer imputed for their spouse.

However, the Supreme Court decision brings about new changes when it comes to domestic partnerships. Companies that previously offered domestic partner benefits may no longer choose to do so since same sex spouses are now recognized. And if companies do continue to offer domestic partner benefits, they are not recognized as spousal benefits under the ACA and therefore should continue to require income to be imputed.

As we begin the 2016 tax year, it is recommended that all organizations that offer spousal benefits and/or domestic partner benefits work closely with their payroll provider to ensure income is properly imputed if required and that income is not imputed for those employees with same sex spouses. It is also suggested that employers look for their specific state tax guidance around taxation/imputation for spousal and domestic partner benefits. In addition, it is recommended that human resource departments ensure clear and consistent communication has been distributed to employees about policy changes.

For more information, please refer to IRS Notice 2015-86, which details the impact of Obergefell vs Hodges on employee benefits in more detail.

To learn how partial self-insurance can save both your organization

and your employees money, please contact us or download

The Nonprofit Executive's Guide to Partial Self-Insurance:

.png?width=1501&name=Nonstop_Logo-22-Horizontal%20(2).png)