Photo: Yahoo

Photo: Yahoo

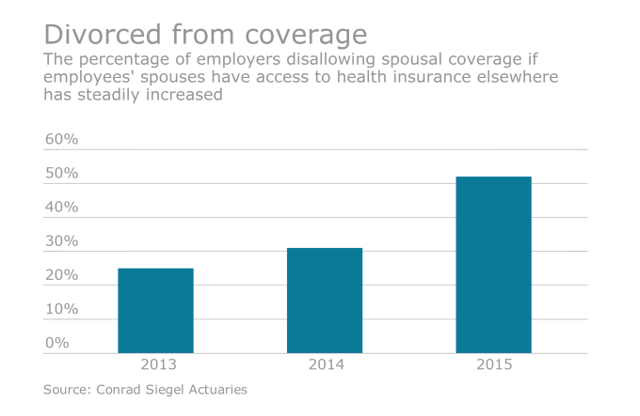

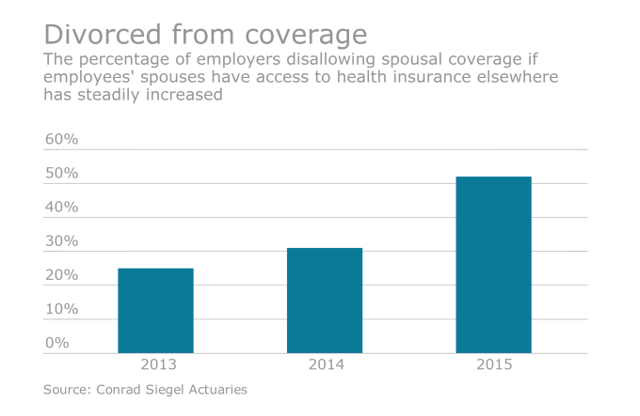

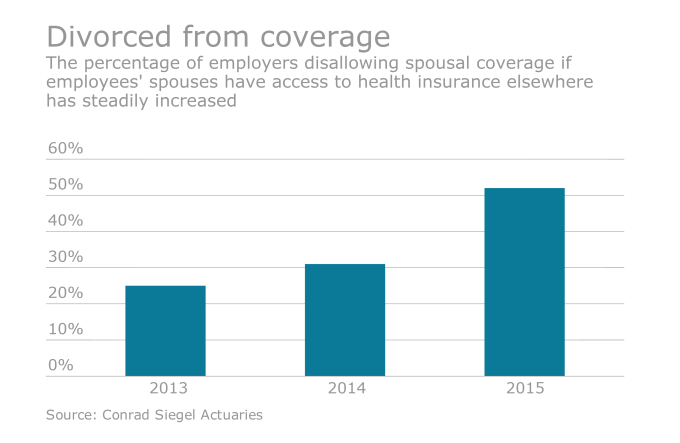

"As plan sponsors try to reduce the costs associated with healthcare claims, many are turning to spousal surcharges or eliminating spousal coverage altogether, according to recent research from actuarial firm Conrad Siegel," writes Sheryl Smolkin, for BenefitsNews.com.

Read the full article at: www.benefitnews.com

Most employers who are putting this practice into effect only do so when the spouse has the option of coverage through their own employer. Changes in benefits and reduction of deductibles has still not been enough to combat the annual rising cost of providing health benefits plans. Spousal surcharges, which have jumped from 16% to 27%, are another way of pushing non-employee spouses to use their own employer's health coverage.

“Whether deductibles are increased or universal spousal benefits are eliminated or company HSA contributions are reduced, it’s all a symptom of the same problem,” concludes Rod Glus, a consulting actuary in central Pennsylvania. “Healthcare costs keep on going up and employers are looking for plan design changes that will reduce the impact on their bottom line.”

Explore your options for saving money on health

benefits plans by signing up for our FREE webinar today!

.png?width=1501&name=Nonstop_Logo-22-Horizontal%20(2).png)