The First Time Around: The Nuts and Bolts of IRS Reporting Requirements (part 1)

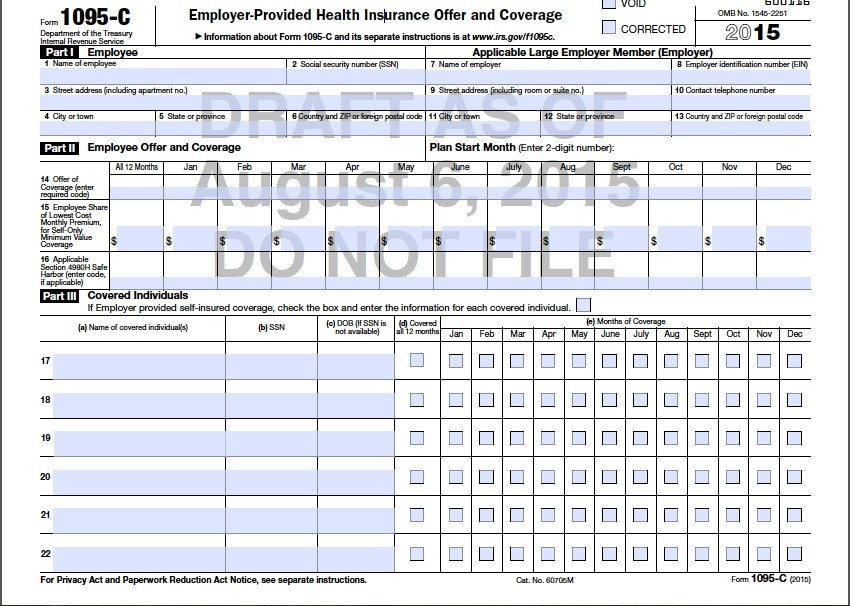

This year marks the first year applicable large employers (ALE; 50+ full time or full-time equivalent employees) are required to report employer-sponsored healthcare coverage to the IRS and provide statements to full-time employees under IRS Sections 6055 and 6056. To help circumvent common misperceptions and errors, this two-part blog series will look at: 1) what needs to be reported, what forms need to be used, and who needs to comply with reporting requirements; and 2) methods of reporting, deadlines, and penalty relief.

.png?width=1501&name=Nonstop_Logo-22-Horizontal%20(2).png)