Price Research 101

No one likes getting bills, especially unexpected ones. If you have ever had a health care procedure and received the bill in the mail with shock and dismay, this information is for you.

No one likes getting bills, especially unexpected ones. If you have ever had a health care procedure and received the bill in the mail with shock and dismay, this information is for you.

There are all types of health care providers and you probably have some that you prefer over others. It’s important to know who is within your Provider Network (also called in-network).

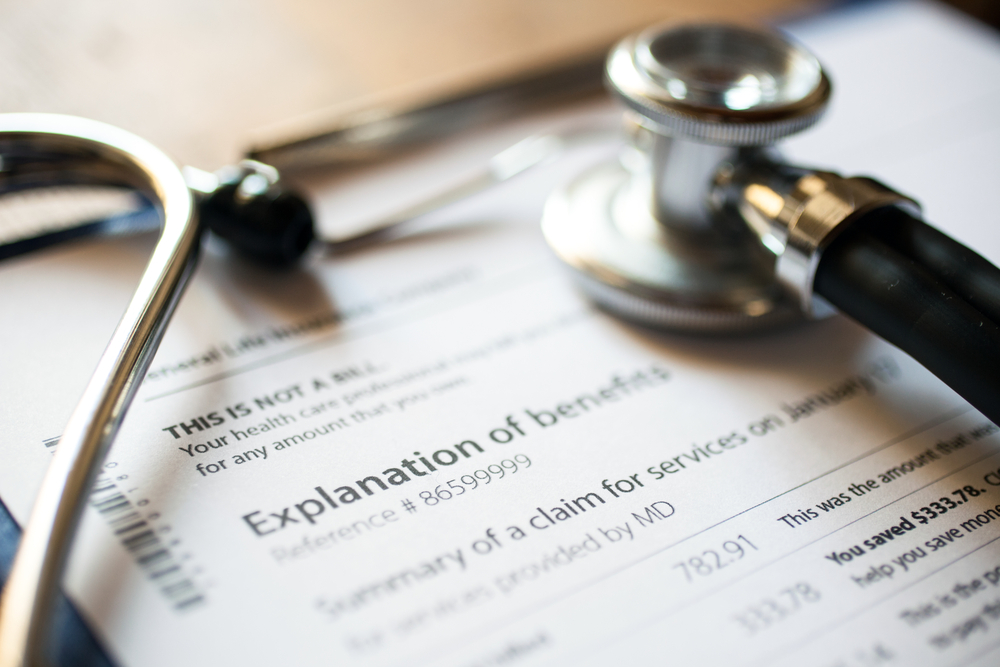

You know that document that comes from your health insurance company that you almost always think is a bill at first? Yep, that one - The Explanation of Benefits or EOB. You're not alone! Many people confuse it with a bill which is why SOMEWHERE on the EOB it should say boldly THIS IS NOT A BILL.

Routine health visits, often called check-ups or well-visits, are a great time to discuss your health concerns with your healthcare provider. You can talk to them about anything, but here are some topics that are generally covered:

Health insurance is complicated. While it’s something we all have a need for, almost none of us are formally taught what the options are, what to look for, or what circumstances might indicate a propensity for one plan over another.

If you don’t already have a primary care provider (PCP), you should seriously consider finding one. It’s a good idea for everyone to have a PCP.

Partial self-insurance (PSI) is a healthcare model where employers purchase less expensive high deductible healthcare plans (HDHPs) for employees.

Direction Service is a non-profit organization located in Springfield, OR that specializes in multi-service care for individuals and families dealing with various disabilities. They are a company of roughly 54 employees that has managed to provide care for over 2,000 families in their area.

Nobody knows a company's financial situation better than the CFO, and most times, they aren't even involved in the process of choosing the right health care plans for their employees. In order to evaluate plans effectively and come up with a well-rounded solution, it's important that all parties (CEO, HR team, and CFO) be involved in the health care purchasing process.

For small-to-midsize nonprofits, choosing an insurance plan might seem daunting. With so many options available, it can be hard to distinguish between them all and to identify what is the best fit for your organization. The advice of a broker or consultant can be beneficial, but they shouldn't be the only one you consult when it comes to choosing a plan.