A Better Solution to Cost-Shifting in Preparation for the (Potential) Cadillac Tax

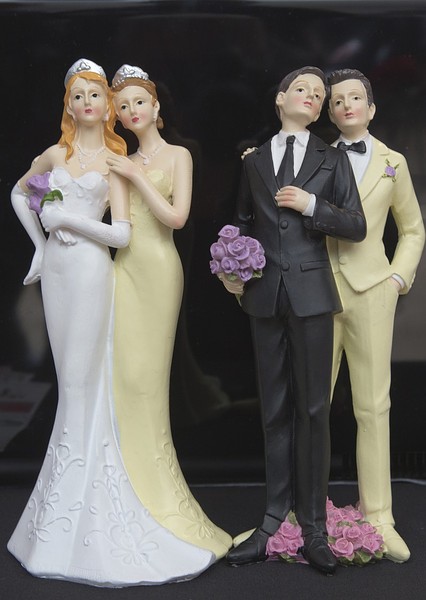

Photo: DeviantArt

With the recently announced two-year delay of the Cadillac tax (from 2018 to 2020) and the pending presidential election debating the entirety of the ACA, its unclear if the 40% excise tax will ever become a reality. In theory, the tax is meant to reduce employer and employee healthcare spending and help fund the expansion of the ACA. In reality, companies of all sizes are fighting against it saying that the toll will significantly impact the affordability and accessibility of healthcare for US workers. And with healthcare costs skyrocketing, well beyond normal wage growth and inflation, the Cadillac tax seems almost unavoidable, if it comes to fruition in 2020.

.png?width=1501&name=Nonstop_Logo-22-Horizontal%20(2).png)