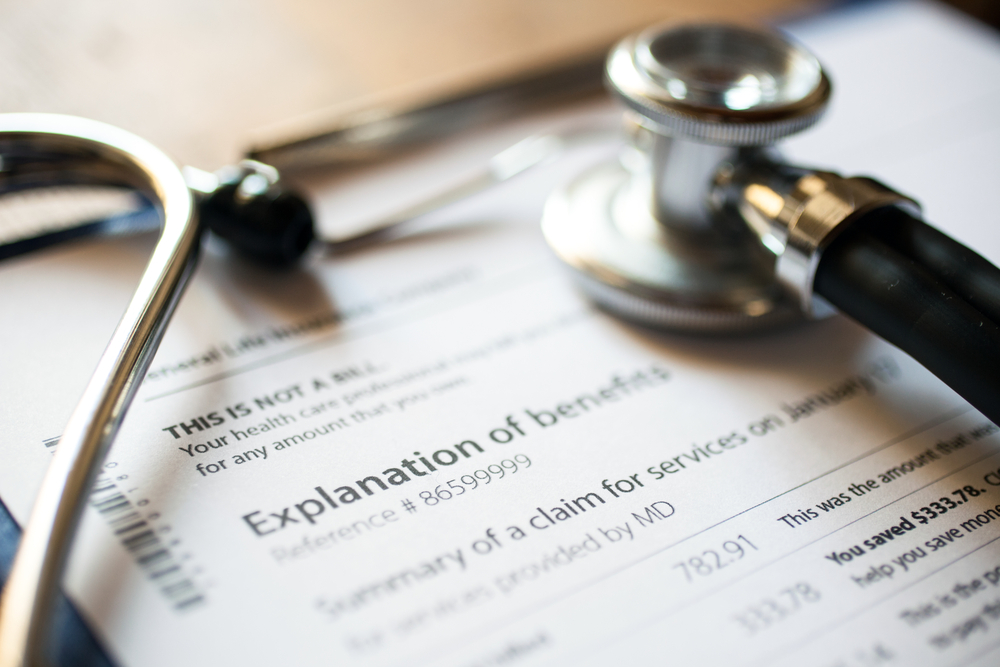

Explanation of Benefits (EOB) Dissected

You know that document that comes from your health insurance company that you almost always think is a bill at first? Yep, that one - The Explanation of Benefits or EOB. You're not alone! Many people confuse it with a bill which is why SOMEWHERE on the EOB it should say boldly THIS IS NOT A BILL.

.png?width=1501&name=Nonstop_Logo-22-Horizontal%20(2).png)