To drive real health care reform, look to what employers are doing - STAT

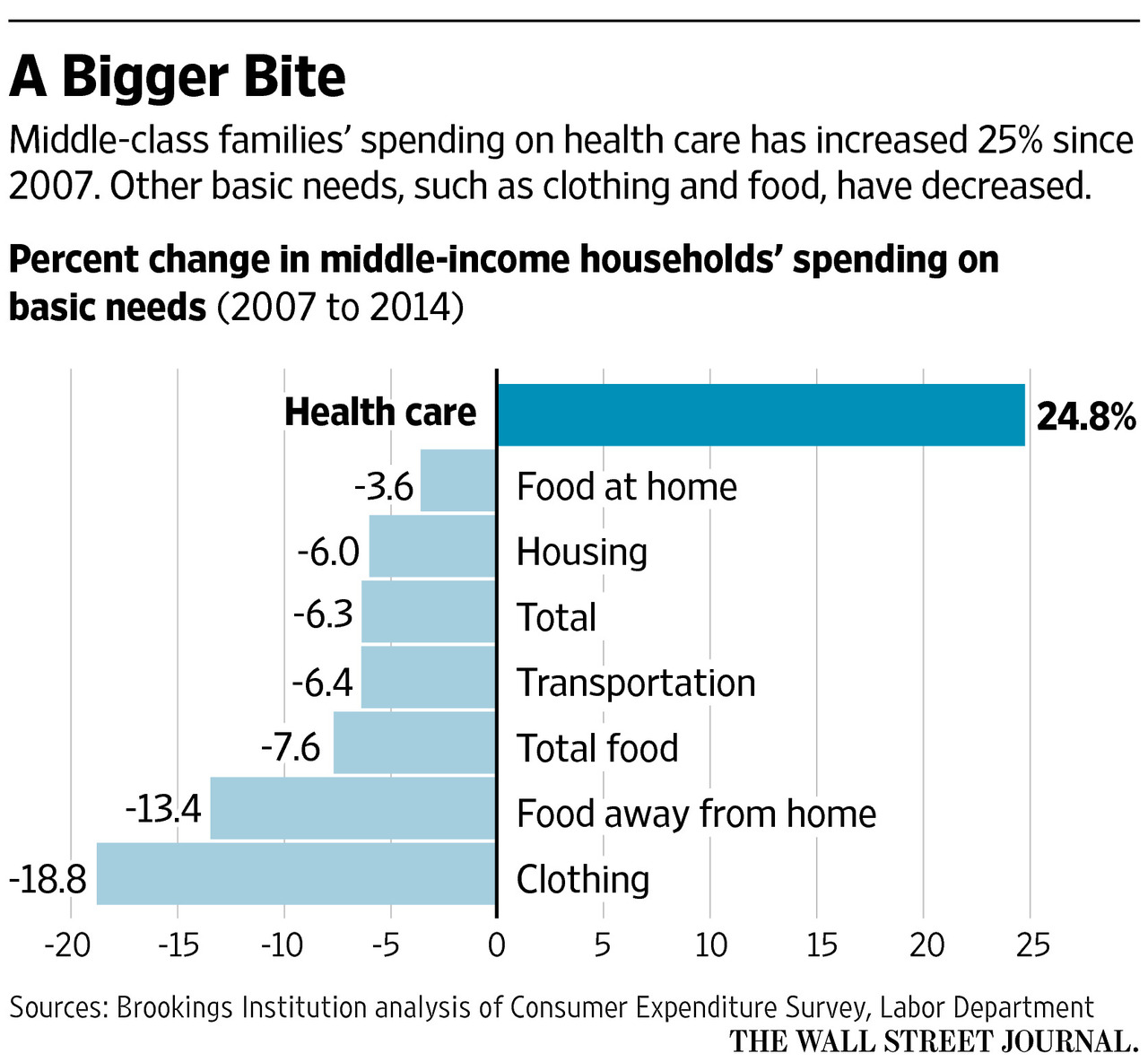

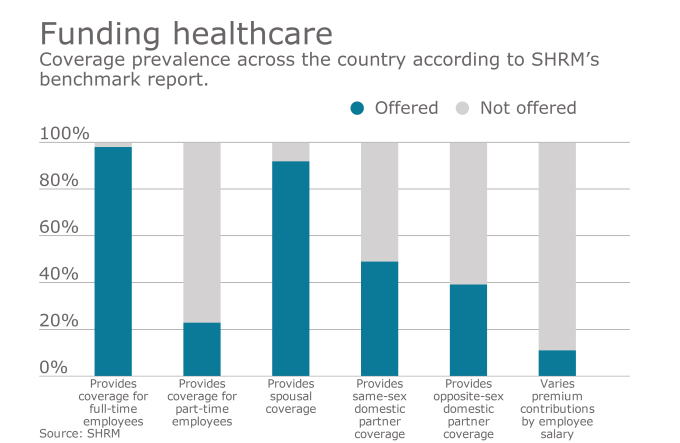

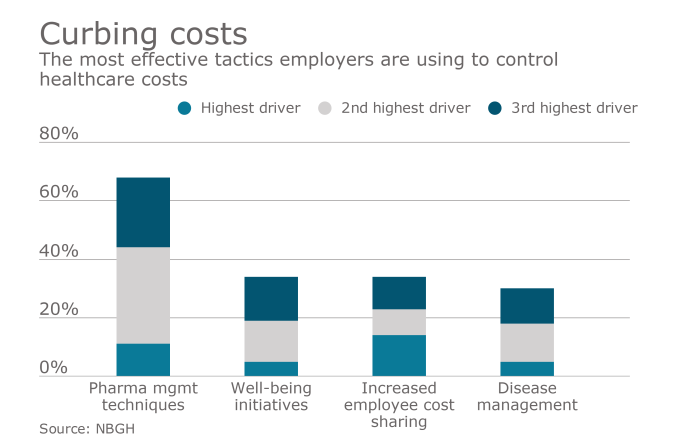

Hank Gardner wrote this article for STAT, discussing recent research about the correlation between healthcare cost increases and slow wage growth, and how employers can carry out “their own do-it-yourself, market-based health care reform.”

.png?width=1501&name=Nonstop_Logo-22-Horizontal%20(2).png)

![[Image: Bloomberg]](https://assets.sourcemedia.com/dims4/default/ce72fa9/2147483647/resize/680x%3E/quality/90/?url=https%3A%2F%2Fassets.sourcemedia.com%2F76%2F13%2Fd40e7af1426d9f2d900ba1f5b602%2Fp2-april21-bloomberg-afternoon.jpg)